Contents

Here our middle band and lower band will behave as the support. So, as a trader, you have to accept a few losses, but follow a win ratio and risk management system. Once the second high is smaller than the first high and the second low is lower than the first low, it is time to start selling. Bollinger Bands standard settings might not work for all traders. Each trader must uniquely identify the settings that best fit his/her trading strategy. To understand this we should know the bands widen when there is a price increase.

It describes the rate at which price changes occur. It has a high predictive power and it is not surprising that it has become a very popular indicator. This strategy uses the RSI indicator together with the Bollinger Bands to go long when the price is below the lower Bollinger Band . This simple strategy only places a long, when both the RSI and the Bollinger Bands indicators are at the same time in a oversold condition.

Categories fails brashly.This system is quite easy to follow and initiating trades solely based on this system is not recommended. I add some tit bits of price action along with this system, while using price action trading India markets. Please note that your stock broker has to return the credit balance lying with them, within three working days in case you have not done any transaction within last 30 calendar days. The price will break through the Bollinger bands with a higher standard deviation less often. These higher settings potentially give us more reliable signals.

Bollinger Bands Trading Strategy: Explained

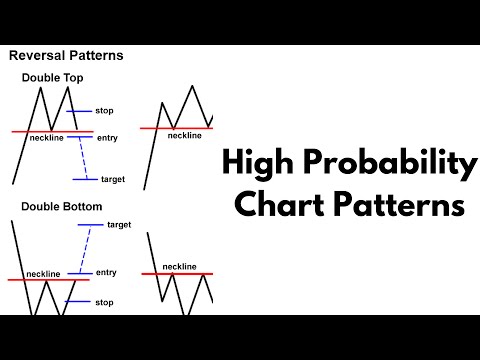

Well, by now you would have already guessed that BB should not be used solely to make buy/sell decisions. You will have to take multiple confirmations from other parameters like candlestick and chart patterns, MACD, RSI, etc. You might have caught that false breakouts are also possible in BB.

- Sell signals all but useless in unchartable 2021 stock marketVirtually all signals that told investors to do anything but buy have done them a disservice this year.

- Technical/Fundamental Analysis Charts & Tools provided for research purpose.

- Prices have the tendency to stay between those Bands.

- If there’s a breakdown at the lower band, the price tends to move down and creates shorting opportunity with firm bearish confirmations.

- Fusion Mediawould like to remind you that the data contained in this website is not necessarily real-time nor accurate.

- We are successfully altering the levels of extremes that the price has to go to break through them.

Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. Stock brokers can accept securities as margins from clients only by way of pledge in the depository system w.e.f September 01, 2020. We are successfully altering the levels of extremes that the price has to go to break through them.

The Complete Stock Market Technical Analysis Course

Bollinger suggested to use it with two or three other non-correlated trading tools to get right market signals. Breakouts are price points that fall outside the price bands. It is not a common phenomenon and shouldn’t be treated as a market signal. It only tells you when the market is more agile or less.

This refers to the length of time over which the indicator is calculated from the price action. Bollinger warns that prices breaking upper or lower limits don’t signal changing trends or give trading signals. Prices close to upper limit don’t indicate bullish trends and vice versa. For a trader, there’s nothing more satisfying than a timely and useful trading tip. In swing trading, the bands give the trader the leverage to follow the trend efficiently.

By checking this box, you confirm that you have read and are agreeing to our terms of use regarding the storage of the data submitted through this form. The philosophy of this trading method is to enter into a long or short position once momentum has been established in that direction. This is simply Bollinger Bands calculated with HMA! The Hull Moving Average attempts to minimize the lag of a traditional moving average while retaining the smoothness of the moving average line.

What is Bollinger Band Indicator?

Short position is closed when the prices hit the lower band. Some traders like to go short when the price fall below the Simple Moving Average Line and take profits when price moves to lower band. Narrow Bollinger Bands are indicative of impending big move in security prices in coming days. This is also indicative of a trend reversal in security prices.

In the previous example, for long-term we were buying at value points and selling at high points. In Swing trading, we follow the trend with Bollinger bands. For this, Bollinger bands are not enough, and you will need to apply other indicators, so be careful. So, before you initiate buy or sell, you have to first understand the trend.

Working and Trading Strategies of Bollinger bands

Check the Bajaj Finance Chart and view the period of squeeze and expansion. You will witness that expansion occurred cycle view of supply chain process after a period of steadiness . The Upper Band denotes the high price and the bottom band denotes the low price.

Sell signals all but useless in unchartable 2021 stock marketVirtually all signals that told investors to do anything but buy have done them a disservice this year. Bollinger Bands are somewhat like moving average envelopes, but drawing calculations for both is different. In Bollinger Bands, standard deviation levels are considered to draw the upper and lower lines, whereas for Moving Average Envelopes, the lines are plotted by taking a fixed percentage. Increasing the standard deviation will increase the distance of the bands from the central lines, and the price will break the bands less often.

Like what you read? Then Share it !

In my previous blog, moving averages, we spoke about Simple Moving Average. Standard deviation is the measure of the amount of variation of a set of data from its mean. Now with this in mind, let us look at the Bollinger band.

The default values are 20 for period, and 2 for standard deviations, although you may customize the combinations. However, during the downtrends phase, traders avoid trading, but they find it the best buying opportunity. It is a well known Intraday Indicator or Technical Analysis Tool used by traders & technical analyst. Buy when price hits Lower Band when the band is expanded if validated by price action .

Trailing stop losses and riding the trend is an effective strategy here. If one wants a quick momentum trade, you can exit if the price falls below upper BB. If you want to https://1investing.in/ continue holding the position, you can hold as long as the ROC stays above zero. The rate of change indicator , one of the best-known oscillators in technical analysis.

Sell when price pierces below the Middle Band if it is validated by MACD or volumes. If this happens when the band is squeezed, you can hold the short for a longer period or consider buying PEs. Sell when price hits Upper Band when the band is expanded and so long it is validated by price action . A big space between the upper and lower bands indicates high price volatility; a small space indicates low. The standard deviation setting of the Bollinger bands is 2. Using fewer periods makes it more reactive and uneven upper and lower bands.

Undoubtedly, it is quite a famous technical analysis tool developed using moving averages and standard deviations techniques. It is overbought when the price reaches the upper band; the asset trades at a higher price. Look to sell the asset as the price tends to fall back towards the central moving average band. In this graph, the middle line represents a simple moving average.

In case there is strength in the stock price it may push the band on either side. This indicator works wonders in intraday trading as liquidity drives day trading. In case it goes up or below the band, then the stock retraces back generally from the middle band.

Since it is calculated based on a simple moving average, more weight is placed on old data than recent ones. It dilutes the significance of new data and might impact decision making. Traders must adjust it to suit their needs and also must take current information into account while making trading decisions. In this graph, first we have a downtrend, then sideways, but after that we see high points.